- HOME

- SUSTAINABILITY

- GOVERNANCE

GOVERNANCE

BASIC APPROACH

We believe that, as an enterprise made up of numerous stakeholders, the INTAGE Group has an important responsibility not only to improve business results but also to ensure the soundness, fairness and transparency of management.

Our corporate philosophy, "THE INTAGE GROUP WAY," is the cornerstone of our management. To act consistent with that philosophy, the INTAGE Group's "Ethical Charter" has been established as a set of guidelines that all of the Group's executives and employees must follow in conducting business activities.

Based on this charter, the Group has formulated the INTAGE Group "Employee Code of Conduct," which defines the basic attitude and behavior expected of employees. The Code of Conduct is instilled in the Group's executives and employees to ensure that they carry out sound business activities in compliance with laws and regulations. In addition, the Group's internal control system is managed in accordance with its "Basic Policy on Internal Control Systems."

CORPORATE GOVERNANCE BASIC POLICY

On June 17, 2016, we formulated the Basic Policy on Corporate Governance. This policy statement defines our basic approach, structure, and management policy concerning corporate governance, with the objective of increasing corporate value through our sound business activities in adherence to compliance standards under our corporate philosophy "THE INTAGE GROUP WAY."

CHANGE IN GOVERNANCE

Since 2013 when we adopted a holding company structure, we have changed our corporate governance structure and system.

In 2016, we transitioned from being a company with a Board of Corporate Auditors to a company with an Audit & Supervisory Committee, with the objective of arranging an environment that supports appropriate risk taking on the business execution side. We have also aimed at strengthening the oversight and supervision function of the Board of Directors, accelerating decision-making through the delegation of authority, and raising the level of fairness, transparency, and effectiveness in business execution.

In 2022, in addition to the external evaluation of the effectiveness of the Board of Directors which has taken place since 2019, we have decided to introduce a restricted stock compensation plan with the aim of providing incentives to continuously improve the corporate value of the Company and promoting further sharing of value with shareholders. We have also changed the composition of outside directors.

In 2023, following the conclusion of a capital and business alliance agreement with NTT DOCOMO, Inc. (DOCOMO) and becoming DOCOMO's subsidiary, two members (including one director who is an Audit & Supervisory Committee Member) have joined the Board of Directors.

From the perspective of protecting minority shareholders, a Governance Committee has been established to appropriately deliberate and examine conflict of interest risks.

The committee reviews transactions with the NTT Group and other matters, and the content of these deliberations is resolved by the Board of Directors.

We will continue to strive to foster optimal corporate governance in accordance with the business and management environment.

| 2013 | - Moved to a holding company structure and changed the corporate name to INTAGE Holdings Inc. |

|---|---|

| 2014 | - Adopted the performance-linked, share-based compensation plan |

| 2015 | - Appointed a woman as director (outside director) |

| 2016 | - Changed to a company with an Audit & Supervisory Committee - Implemented the first evaluation of effectiveness of the Board of Directors by external persons - The share of outside directors in the Board of Directors exceeded 30% |

| 2019 | - Revised the performance-linked, share-based compensation plan - Increased the number of female directors to two |

| 2020 | - Implemented the evaluation of effectiveness of the Board of Directors by external persons - Increased the number of directors from six to seven |

| 2021 | - Implemented the external evaluation of effectiveness of the Board of Directors |

| 2022 | - Implemented the evaluation of effectiveness of the Board of Directors by external persons - Increased the number of outside directors by one - Appointed two outside directors with management experience - Introduced a restricted stock compensation plan |

| 2023 | - Implemented the evaluation of effectiveness of the Board of Directors by external persons - Increased the number of directors by two in connection with becoming a subsidiary of DOCOMO (including one director who is an Audit & Supervisory Committee Member) |

| 2024 | - Decreased the number of directors from 13 to 12 |

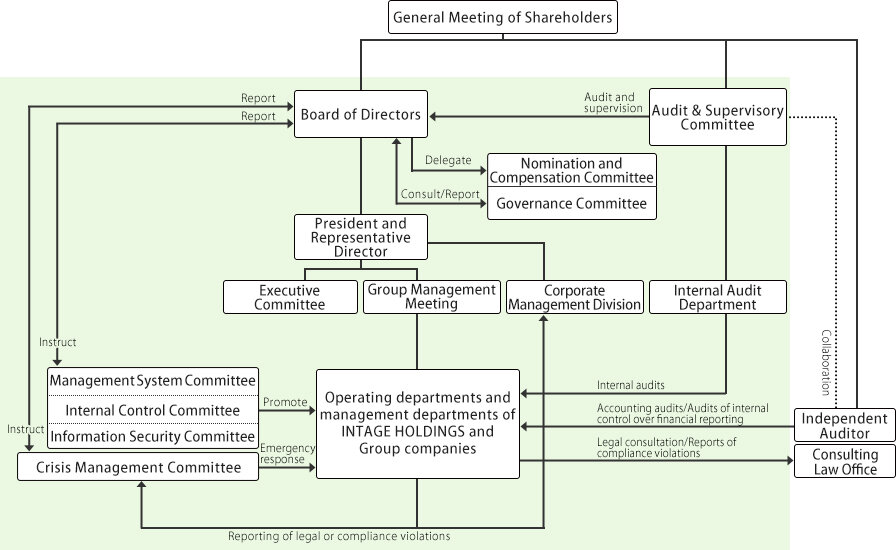

CORPORATE GOVERNANCE STRUCTURE

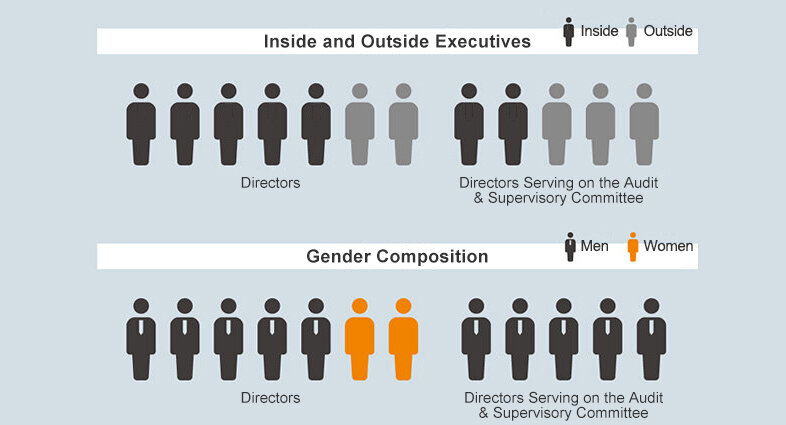

The Board of Directors consists of seven directors (excluding directors serving as Audit & Supervisory Committee members; including two outside director), and five directors serving as Audit & Supervisory Committee members (including three outside directors).

The Board identifies job authority and operations responsibility for directors, makes decisions on important matters, and oversees the execution of duties by directors.

Based on the Board of Directors Regulations, the Board meets once a month and holds an extraordinary meeting when needed. As a body to report, discuss, and decide management policy, diverse measures, and various matters concerning business management, a Group Management Meeting is held once a month and is attended by directors (excluding directors serving as Audit & Supervisory Committee members), a full-time director serving on that committee, and executive officers.

In addition, in order to support functions of the Board of Directors, report and discuss various matters, and enhance the efficiency of management, the Executive Committee meets every two weeks, with attendance by directors (excluding directors serving as Audit & Supervisory Committee members), a full-time director serving on that committee, and executive officers.

The Company has also established several committees: the Internal Control Committee, in order to promote internal control initiatives of the Group; the Crisis Management Committee, to respond to crises involving business operations of the Group; the Management System Committee, to further improve management systems of the Group; and the Information Security Committee, to identify and resolve information security issues.

The Audit & Supervisory Committee consists of five directors serving as Audit & Supervisory Committee members (including three outside directors). Ordinarily, they meet t a month. The committee strives to enhance its audit and supervisory functions concerning the management. For example, a full-time director serving on the committee attends important meetings, such as the Internal Control Committee, and compiles opinions of the Audit & Supervisory Committee on reports of his work to other directors serving on the Audit & Supervisory Committee (outside directors). Further, directors serving as Audit & Supervisory Committee members attend, in addition to the Board of Directors meetings, important meetings, such as the Group Management Meeting, Executive Committee, Internal Control Committee, Crisis Management Committee, Management System Committee, and the Information Security Committee, in order to understand the process of making important decisions and the status of execution of operations, inspect requests for approval and other important documents on execution of operations, and ask employees for explanations on an as-needed basis.

They also understand the conditions of group companies, through collaboration with the Internal Audit Department, regular briefings from it, and communications with auditors of the INTAGE Group.

The Internal Audit Department, which is in charge of the Company's internal audits, consists of eight persons and conducts auditing of the Company and Group companies, from the perspective of whether the companies are fairly, appropriately, and effectively managed and execute operations, based on both shared management philosophy and policy as well as various rules.

With regard to the audit process, the Department checks audit plans, execution of audits, reporting of audit results, and status of improvement, based on the Company's "Internal Audit Rules and Execution Standard. "The Audit & Supervisory Committee and the Internal Audit Department also hold regularly scheduled liaison meetings, with the aim of improving effectiveness and efficiency of audits by both.

Liaison meetings confirm the audit policy and plan at the beginning of a fiscal year, and members closely collaborate by exchanging opinions on internal audit reports, during and at the end of the year.

CORPORATE GOVERNANCE STRUCTURE CHART

COMPOSITION OF MANAGEMENT (AS OF SEPTEMBER 2024)

COMMENTS FROM AN OUTSIDE DIRECTOR

INTERNAL REPORTING SYSTEM

The INTAGE Group has created the Compliance Violation Reporting Rules based on the spirit of the Whistleblower Protection Act, to ensure the early detection and correction of misconduct, maintain public trust in the INTAGE Group, and ensure the fairness of business operations.

Employees of the INTAGE Group (including temporary and part-time employees) are obliged to report any violations of compliance if they are discovered, and a system is in place for reporting such violations either under their own names or anonymously to the internal reporting and internal consultation service set up within the Company or to the Company's legal counsel.

EVALUATION OF THE EFFECTIVENESS OF THE BOARD OF DIRECTORS (FISCAL 2023)

The Board of Directors analyzes and evaluates its effectiveness as a whole, referencing relevant information including the questionnaire self-evaluations completed by each director, and it discloses a summary of the results of its analysis and evaluation.

In addition, the chairman of the Board of Directors regularly listens to opinions on the management of the board from outside directors. (Article 22 of the Basic Policy on Corporate Governance)

OUTLINE OF THE EVALUATION IN AUGUST 2024

Interviews of 13 directors (eight directors who are not members of the Audit & Supervisory Committee and five who are) and the analysis of the results were conducted in August 2024.

We have been working with external consultants since 2020, with the goal of having a more objective understanding of the matters that we should improve to further enhance the effectiveness of the Board of Directors.

In 2024 again, we prepared the questionnaire, heard opinions, and analyzed the results.

We received a report from the external consultant at the Board of Directors meeting in September and confirmed the evaluation results and measures to be taken.

The questionnaire items for 2024 were prepared from the same perspectives as the previous year, including the composition and operation of the Board of Directors, strategy discussions, risk management, evaluations and compensation, and dialogue with shareholders and other stakeholders.

In addition, the status of the initiatives to address from the previous year was also included in the evaluation items.

EVALUATION RESULTS

According to the evaluation results, based on a recognition that the composition and operation of the Board of Directors and the Nomination and Compensation Committees continue to be appropriate, it was again confirmed that the Board of Directors discusses the Company's management issues by paying respect to the opinions expressed by independent outside directors.

This is evidenced in part by independent outside directors presenting constructive opinions to top management proactively, through sufficient explanations of meeting agenda items being provided to directors.

In addition, to protect the interests of the Company's minority shareholders regarding the INTAGE Group's transactions with Nippon Telegraph and Telephone Corporation, which is the Company's parent company, and its group companies, the Governance Committee, which consists of independent outside directors, was established as an advisory body in charge of monitoring and supervising those transactions.

Examining the information available, including the Governance Committee's activities and reports to the Board of Directors, the results of the evaluation indicate that the Board of Directors has maintained its effectiveness in making decisions regarding key management matters and appropriately supervising the execution of business.

FUTURE INITIATIVES

In the evaluation conducted in the previous year, the following tasks for maximizing the Board of Director's effectiveness to enhance corporate value were identified: i) management strategy taking into account the external environment and other factors, ii) review of the business portfolio, iii) allocation of management resources (human capital, intellectual property, etc.), iv) sustainability, and v) crisis response plans and other matters.

Regarding these tasks, the improvement initiatives that followed, including the PDCA cycle, were evaluated highly.

However, the continuing need to implement and accelerate improvement initiatives was reaffirmed.

To further enhance the discussions of the Board of Directors in light of these evaluation results, further improvements and creative measures will be implemented and considered through efforts such as increasing the number of important topics on the discussion agenda of the Board of Directors and continuing to review the way information is provided to directors, including the detailed examination of reported matters to enhance the board's monitoring function.

NOMINATION AND COMPENSATION COMMITTEE

ACTIVITY OVERVIEW

The two committees meet as needed, with meetings lasting approx. 60 minutes per session.

Both committees are chaired by outside directors who are members of the Audit & Supervisory Committee.

In July 2024, Yoshiya Nishi became the new President and Representative Director of the Company.

With a view toward the future selection of director candidates and candidates for the position of President and Representative Director, the Company creates opportunities for the Nomination Committee to meet, conduct interviews, and take other measures where necessary as described at right.

The committee also has its members select human resources who would be suitable directors.

NOMINATION COMMITTEE

With independent outside directors playing leading roles in discussions, this committee evaluates and selects director candidates applying external knowledge for the development of internal human resources, including director candidates.

The director candidates nominated by the committee are people who are excellent in terms of their personality and insight, capable of appropriately fulfilling the duty of care of a good manager as directors, able to give advice and recommendations to ensure the validity and appropriateness of the decisions made by the Board of Directors based on their professional careers and expertise, and who are believed to be able to help enhance the corporate value of the Company.

The committee selects these human resources and reports its decisions to the Board of Directors.

COMPENSATION COMMITTEE

In accordance with a resolution at a General Meeting of Shareholders, a director in charge of the matter prepares a draft of payments regarding the specific details of the compensation and other benefits paid to directors (excluding outside directors and directors who are members of the Audit & Supervisory Committee), including the amount, timing, allocation and other specific details of payments.

Based on this draft of payments, the Compensation Committee determines base compensation, performance-linked monetary compensation, and performance-linked stock-based compensation as delegated by the Board of Directors.

The committee also discusses restricted stock-based compensation and submits reports to the Board of Directors.

COMPOSITION AND MEETINGS HELD

| Composition (As of October 2024) | ||

|---|---|---|

| Independent outside directors 5 | Chairman | Hajime Nakajima |

| Members | Yuzo Miyama / Shizuo Kashima / Atsuhiro ImaI / Hiroko Watanabe | |

| Inside directors 3 | Members | Yoshiya Nishi / Toshio Odagiri / Satoshi Nagai |

| Number of meetings held and topics discussed (FY2023 results) | ||

|---|---|---|

| Number of meetings 4 | The following were resolved and reported on. | |

| [Resolution] 6 | Director candidates to be proposed at the General Meeting of Shareholders, compensation of individual directors, etc. | |

| [Report] 2 | Matters to be discussed by Nomination and Compensation Committees in the future, etc. | |

DIRECTORS' COMPENSATION (FY2023)

Compensation for directors (excluding outside directors and directors who are members of the Audit & Supervisory Committee) is made up of monetary compensation and stock-based compensation.

The percentages of these paid are determined by comprehensively taking into account a director's position and responsibilities, business performance, the degree of target achievement and so on. In addition, the percentage of compensation linked to medium- and long-term business performance and the proportions of monetary compensation to stock-based compensation are set as appropriate to ensure that the system functions as a healthy incentive aimed at sharing value with shareholders and facilitating sustainable growth.

The compensation of outside directors who are not members of the Audit & Supervisory Committee comprises only the "base compensation" described in (i) a.

(i) Monetary compensation

The following monetary compensation is paid within the range of compensation based on resolution by the 44th Ordinary General Meeting of Shareholders.

a. Base compensation

Base compensation is determined based on position, roles, responsibilities and other factors.

b. Performance-linked monetary compensation

Performance-linked monetary compensation is calculated by multiplying a base amount, which uses consolidated operating profit for the previous fiscal year as its metric, by a designated coefficient according to position, taking an individual assessment-based amount based on role-specific results, and adding the two figures.

(ii) Stock-based compensation

Stock-based compensation comprises the following.

a. Performance-linked stock-based compensation

This is a type of stock-based compensation that was continued and partially revised by resolution of the 47th Ordinary General Meeting of Shareholders. In accordance with the Stock-based Benefits Regulations, in each fiscal year points are awarded based on a director's position and the degree of achievement of performance targets. In principle at the time of a director's retirement, shares in the Company corresponding to the accumulated number of points (with one point converted to one share of the common stock in the Company), and monetary proceeds from the conversion of common stock in the Company, are paid to the director through a trust.

b. Restricted stock-based compensation

This is a type of stock-based compensation established by resolution of the 50th Ordinary General Meeting of Shareholders. Based on their positions, each fiscal year directors are granted monetary claims as compensation for the granting of transfer-restricted shares. The directors make in-kind contributions of all of these monetary claims, and in turn receive shares in the Company whose transfer is restricted over a certain period. Note that compensation shall be within the limit set by resolution of the 44th Ordinary General Meeting of Shareholders, and shall not exceed ¥90 million per year.

Regarding specific details concerning the amount, payment timing and allocation, etc., of compensation and other such benefits of directors who are not members of the Audit & Supervisory Committee (excluding outside directors), a director in charge is to prepare a payment draft in accordance with resolution of the General Meeting of Shareholders.

Base compensation, performance-linked monetary compensation and performance-linked stock-based compensation are determined, under delegation by the Board of Directors, by a separately established committee pertaining to compensation ("Compensation Committee," hereafter) whose members comprise the President and Representative Director, directors who are members of the Audit & Supervisory Committee and independent outside directors, in which a majority of members are independent outside directors. Restricted stockbased compensation is determined by the Board of Directors following deliberation by the Compensation Committee.

The compensation of outside directors who are not members of the Audit & Supervisory Committee comprises only base compensation. Specific details concerning the amount, payment timing and allocation, etc. of this compensation are determined by the Compensation Committee under delegation by the Board of Directors, in accordance with resolution of the General Meeting of Shareholders.

The compensation of directors who are members of the Audit & Supervisory Committee comprises only base compensation. Specific details concerning the amount, payment timing and allocation, etc. of this compensation are determined by consultation between the directors who are members of the Audit & Supervisory Committee within the compensation limits established by resolution of the 44th Ordinary General Meeting of Shareholders.

After this policy for the determination of compensation was first approved by the Board of Directors on February 19, 2021, revisions to the policy were later approved by the Board of Directors on August 19, 2022 due to the introduction of restricted stock-based compensation.

When determining details such as the individual compensation of directors in the fiscal year under review, since the Compensation Committee made its determinations as a result of multi-faceted considerations including consistency with the policy for determining compensation described above, for its part the Board of Directors judges that the determinations have been made in consistency with said policy.

Total amount of compensation for each category of directors, total amount by type of compensation, and number of directors

| Category | Total amount of compensation (thousand yen) |

Total amount by type of compensation (thousand yen) |

Number of eligible directors | |||

|---|---|---|---|---|---|---|

| Monetary compensation | Stock-based compensation | |||||

| Basic compensation | Performancelinked monetary compensation | Performancelinked stock-based compensation | Restricted stockbased compensation | |||

| Director (excluding Audit & Supervisory Committee members) (excluding outside directors) |

237,620 | 48,000 | 129,537 | 2,441 | 57,641 | 7 |

| Director (Audit & Supervisory Committee members) (excluding outside directors) |

19,200 | 19,200 | - | - | - | 2 |

| Outside directors | 36,000 | 36,000 | - | - | - | 5 |